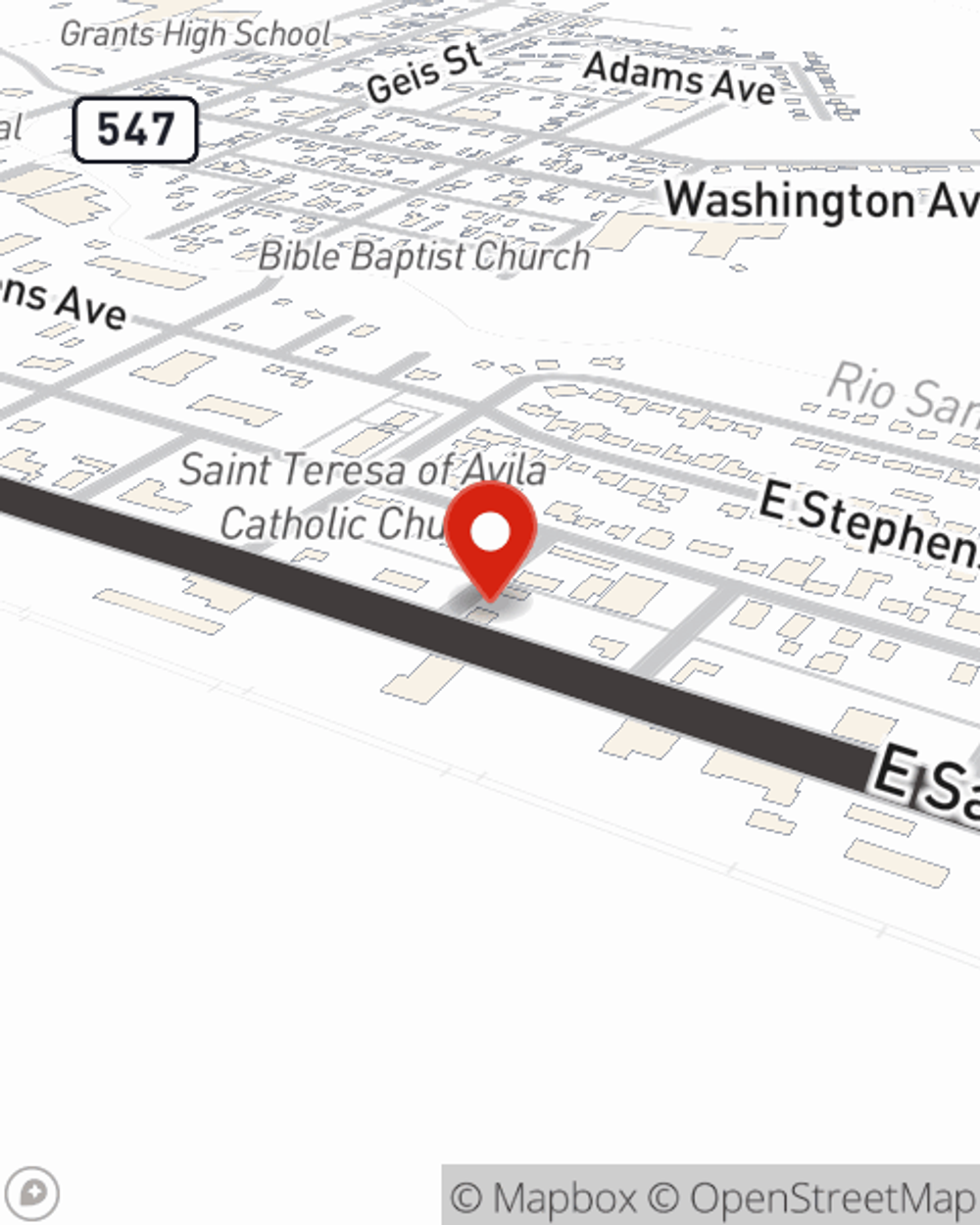

Life Insurance in and around Grants

State Farm can help insure you and your loved ones

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

Be There For Your Loved Ones

Taking care of those you love is a big deal. You help them make decisions go to work to provide for them, and take time to plan for the future. That includes getting the proper life insurance to care for them even if you can't be there.

State Farm can help insure you and your loved ones

Now is a good time to think about Life insurance

State Farm Can Help You Rest Easy

And State Farm Agent Chris Winch is ready to help design a policy to meet you specific needs, whether you want level or flexible payments with coverage designed to last a lifetime or coverage for a specific number of years. Whichever one you choose, life insurance from State Farm will be there to help your loved ones keeping going, even when you can't be there.

State Farm offers a great option for individuals who thought they couldn't qualify for life insurance: Guaranteed Issue Final Expense. This coverage can prove useful by covering final expenses like medical bills or funeral costs, ensuring that your loved ones won't have to bear the burden. For a free quote on Guaranteed Issue Final Expense, contact Chris Winch, your local State Farm agent and see how you can be there for your loved ones—no matter what.

Have More Questions About Life Insurance?

Call Chris at (505) 287-4551 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

Life insurance basics

Life insurance basics

Understanding life insurance, what it is, how it works and the different types can help you decide which life insurance policy is right for you.

Chris Winch

State Farm® Insurance AgentSimple Insights®

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

Life insurance basics

Life insurance basics

Understanding life insurance, what it is, how it works and the different types can help you decide which life insurance policy is right for you.