Business Insurance in and around Grants

One of the top small business insurance companies in Grants, and beyond.

No funny business here

Coverage With State Farm Can Help Your Small Business.

Do you own an art gallery, a veterinarian or a fabric store? You're in the right place! Finding the right protection for you shouldn't be risky business so you can focus on making this adventure a success.

One of the top small business insurance companies in Grants, and beyond.

No funny business here

Small Business Insurance You Can Count On

When one is as driven about their small business as you are, it makes sense to want to make sure all systems are a go. That's why State Farm has coverage options for commercial auto, business owners policies, artisan and service contractors, and more.

Since 1935, State Farm has helped small businesses manage risk. Contact agent Chris Winch's team to learn about the options specifically available to you!

Simple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

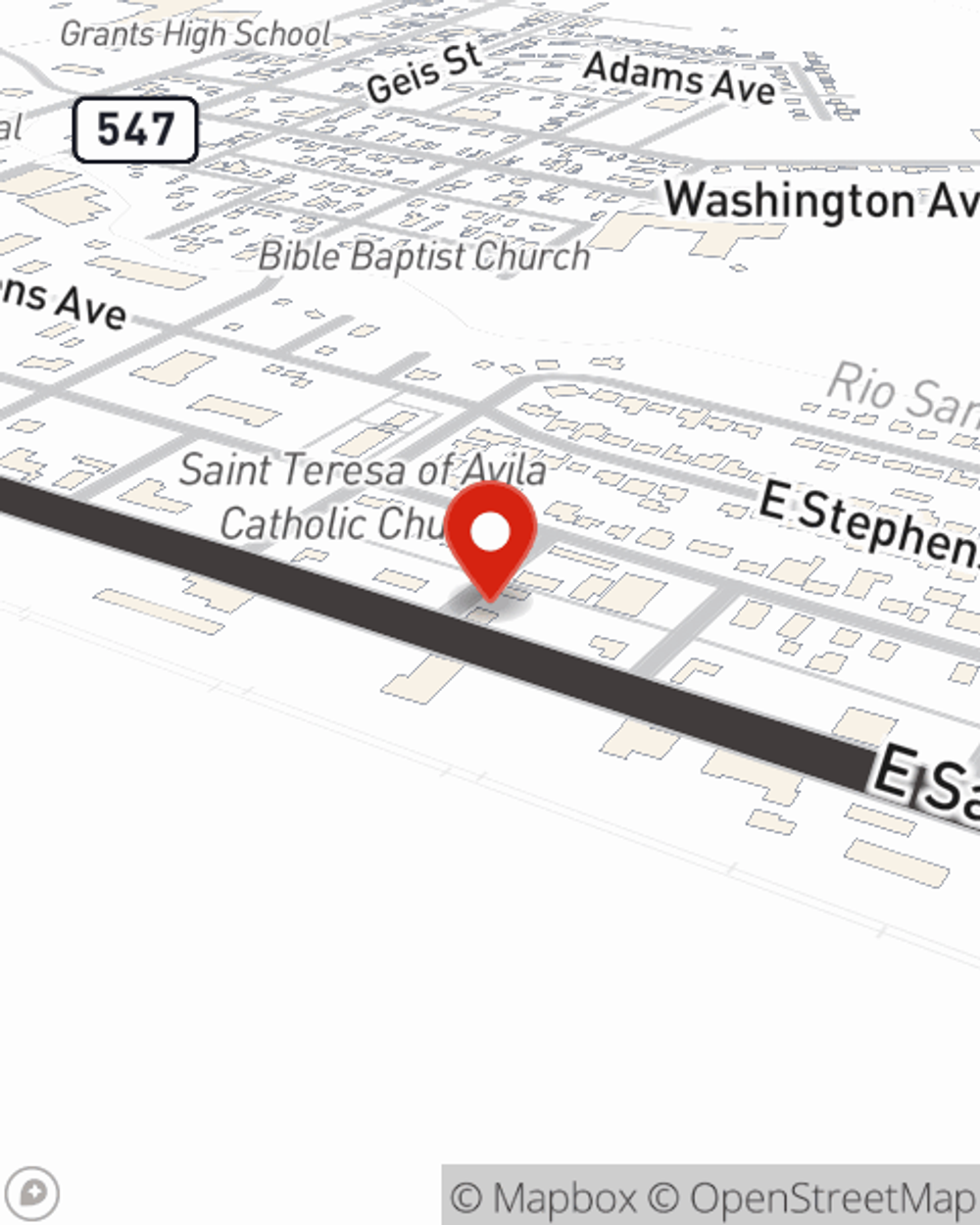

Chris Winch

State Farm® Insurance AgentSimple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?